The statistics which count as Prime Value Emerging Opportunities Fund continues outperformance

Statistics will vary across an investment fund’s life, but there’s one number which has been pretty much constant during Richard Ivers’ three-year stint at the helm of the outperforming Prime Value Emerging Opportunities Fund.

While you won’t see this statistic on monthly, quarterly or yearly reports, this modest and largely hidden number has a big influence on results – the number is two, and it refers to the willingness to meet two companies per day on average over the course of any given year.

Ivers says meeting companies is essential for forming a high conviction view: “When hunting opportunities in smaller companies across the ASX, it’s important to dig deeper and get to know the companies.

“Meeting companies is a discipline. It adds to what we already know through company reports and spreadsheets.”

Performance for the Prime Value Emerging Opportunities Fund suggests the approach is working: since inception, the fund has delivered 16.1% per annum net of fees since inception in 2015.

Since Richard Ivers joined Prime Value nearly three-and-a-half years ago, the fund has delivered more than 20% returns per annum after fees, a consistent top performer among Australian small cap investment funds.

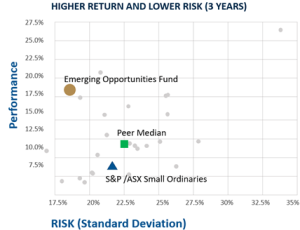

However, Ivers says the most important statistic is risk-adjusted returns. “Outperforming is good, but we’re always looking to outperform with lower risk than the market. We want to deliver top quartile performance with a risk-adjusted return.

“It’s one thing to deliver performance, but another entirely to perform without taking on too much risk.”

Risk-adjusted returns are demonstrated on the below chart. “We want to always be on the left hand side of the index. This chart shows why risk-adjusted returns can be so powerful.”

Source: Lonsec

Yak Yong Quek, founder and CEO of Prime Value Asset Management, said Richard’s humility and commitment to due diligence is key to his success. “Humility is an important characteristic when investing. We all make mistakes. What matters is the humility and decisiveness to admit a mistake and to act. Humility is also essential for the ability to learn.

“Having a high conviction takes character – a lot of research and time and expertise goes into picking those key stocks which stand out.”

Ivers says returns should always be analysed after fees. “There are cheap options which just track the index. But fees only tell part of the story. The PVEOF is still ahead of the index after fees – this is the performance that counts.”

To invest in the Prime Value Emerging Opportunities Fund please contact our Client Services Team at info@primevalue.com.au and 61 3 9098 8088