The end of June looms large in diaries of fund managers around the country

Street Talk

The end of June looms large in diaries of fund managers around the country, many of who claim to generate returns through volatile periods and now have a real chance to prove it.

The ASX saw red through February and April, catching some fund managers off guard.

June 30 is the traditional date fundies rule off their books and lay their 12 month takings bare for all to see. However, with COVID-19 wreaking havoc on investment strategies, we simply couldn’t wait that long.

Street Talk has got its hands on Morningstar’s numbers for the 12 months to May 2020 – from a screen of almost 2500 Aussie equity managers both large and small – to unveil who traded coronavirus the best.

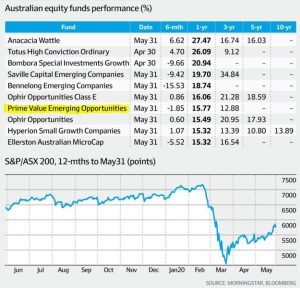

Top of the list was Anacacia Capital’s five-year-old Wattle Fund which returned 27.47 per cent in the year-to-May, and 16.03 per cent for the past five years.

The $600 million fund takes positions in small to medium enterprises, with stakes in the likes of payments processor Smartpay, which is up more than 215 per cent in the past 12 months, and software and services outfit The Objective Corporation, which is up almost 160 per cent to $7.30 over the same period.

The Wattle Fund also has positions in radiology group Integral Diagnostics and $94 million building products supplier Big River, which its private equity arm took public in mid 2017, according to the respective companies’ filings.

Second place on Morningstar’s list went to Totus Capital’s High Conviction fund which posted a 26.09 per cent return for the year. (Note: Morningstar did not have Totus’ May numbers and calculated its performance up to April)

The bronze medal went to Bombora Group’s Special Investments Growth fund, which has a portfolio of pre-IPO and high growth listed companies and returned 20.94 per cent. (This was also the year-to-April).

Bombora’s holdings included health technology company Pacific Knowledge Systems and e- learning platform business Janison Education Group.

Rounding out the top five was Melbourne boutique Saville Capital’s Emerging Companies fund and Bennelong Funds Management’s Emerging Companies Fund, which posted 19.7 per cent and 18.74 per cent annual returns, respectively.

Also featuring in the top 20 were Ellerston’s Australian MicroCap Fund, Ophir Opportunities, Hyperion Small Growth Companies and Hyperion Australian Growth Companies, and Regal Funds Management’s Emerging Companies Fund II.

Those who didn’t fare as well will no doubt say that their performance should be measured over a longer time frame, like five years or a decade, but we all know only three words matter for their investors: numbers don’t lie.

By Sarah Thompson, Anthony Macdonald and Tim Boyd

Source: https://www.afr.com/street-talk/australia-s-top-performing-equity-managers-unveiled-20200608-p550fw