There’s a good reason Prime Value Asset Management’s dynamic small cap duo, portfolio managers Richard Ivers and Mike Younger, have spent much of 2024 on the road, lining up a swag of meets with smaller ASX companies

Following the reporting season just gone, the pair have been prepping their Prime Value Emerging Opportunities Fund – the only small cap fund to be upgraded in the latest Zenith research update to a Highly Recommended rating – for prime positioning ahead of a likely small cap summer.

According to Wilson Advisory, Aussie small caps historically perform better than large caps after the US Fed’s first rate cut of the monetary cycle.

Indeed, in the 12 months immediately following the Fed’s first rate cut, the ASX Small Ordinaries has, on average, gained more than 8 per cent.

The Ivers and Younger fund has outperformed both the Small Ordinaries and Small Industrials by circa 7 per cent per annum over the past six years, while their measured risk remains approximately 18 per cent lower than both indices.

Wilsons says ASX small caps are trading at a “very wide and historically attractive discount relative” to large-cap stocks.

Global small caps are said to be trading at the “largest discount relative to large caps in over 20 years”.

Globally, the story is even more compelling, with the US Russell 2000 small-cap index gaining, on average, well over 20 per cent in the year following the first rate cut.

In previous periods, when small caps have traded at large discounts, they have gone on to deliver strong returns over the next 12 months, particularly when economic conditions and the official policy backdrop turn supportive.

But without having boots on the ground to count the number of cars in the company car park, Younger says you’re playing small caps wrong.

“A discipline to meet companies in person is a critical part of any investment process, but doubly so for small companies,” he said.

“We as investors benefit by looking beyond the charts and the reports, and sitting down with the companies we might be considering for investment.

“At the end of the day we are looking to back companies that we believe have potential. We want to get to know them, to partner with them and grow with them.”

Smaller companies poised

Ivers and Younger agree that small caps currently look poised to surge, following a period where many attractive smaller companies were oversold.

Younger says the likelihood that rate rises are near an end helps to fuel optimism.

“We’re seeing several quality smaller companies which are now attractively valued following a period where they were arguably oversold.

“The small cap market is now at a position where it offers exceptional opportunities for long-term investment returns.”

Mitigating risk in a volatile world

But as always when investing in small cap stocks, managing volatility is key. And the best course to taming volatility is portfolio construction, according to Ivers and Younger.

“We primarily look for quality companies, which demonstrate resilient earnings, but also like to hold some higher growth, higher risk stocks as well,” Ivers said.

“Getting this balance right can provide more evenly distributed returns over time.”

“We’re always conscious to manage volatility because the next challenge is never too far away,” Younger added.

“We are currently optimistic about small cap stocks, and in particular smaller industrials.

“But we’re also realistic that markets are full of surprises.”

“We’ve always felt strongly that managing volatility successfully starts with what you are buying – if you buy well and focus on quality there is a good chance you will deliver returns with lower risk over the longer term,” Ivers concludes.

Now on to three smaller ASX companies currently favoured by Ivers and Younger

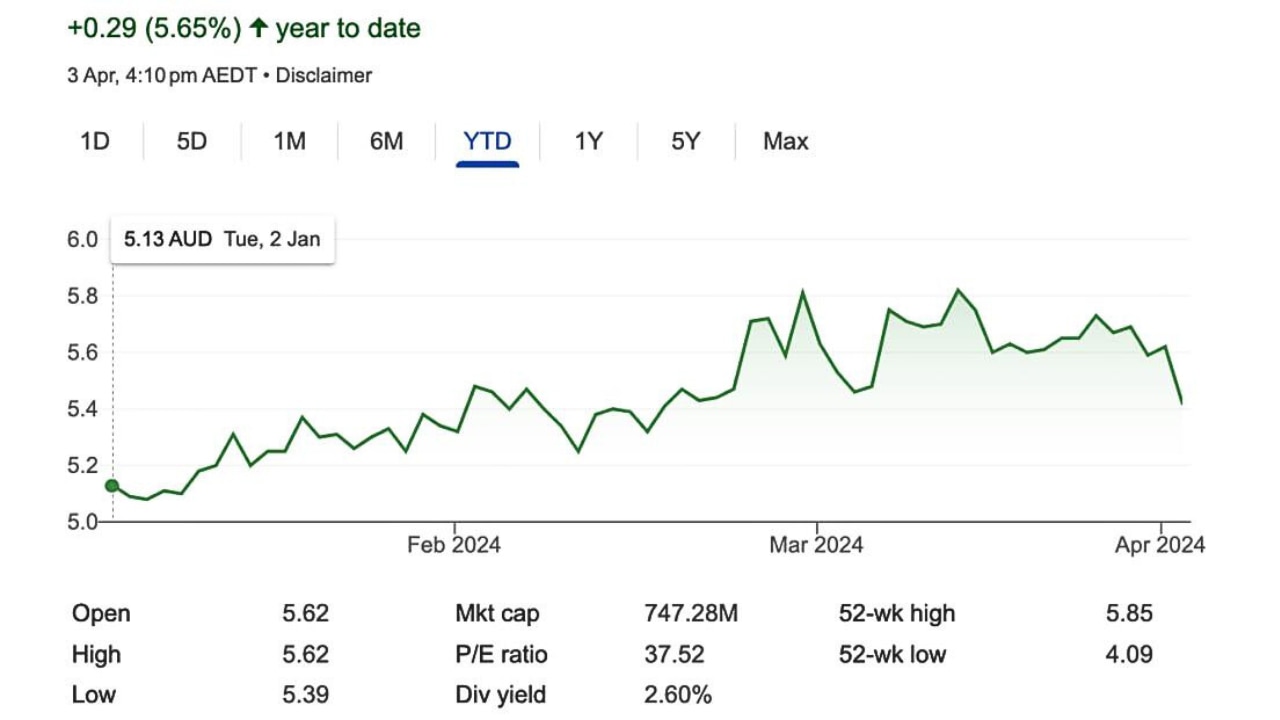

PROPEL FUNERAL PARTNERS (ASX:PFP)

Source: Google

Source: Google

“We have owned Propel Funerals in the fund for approximately three years, and before that it was held in the micro-cap fund, so it’s a company we have followed for many years,” said Younger.

Propel is Australia’s second-largest funeral operator.

“It’s not the most exciting industry, but one with many favourable characteristics including accelerating volume growth due to a growing and ageing population and little correlation to the economic cycle,” Younger said.

“Propel’s stock price was weak during 2023 as the market was concerned by the high death rate in 2022. But we see this as a short-term issue in a long-term growth trend.

“The death rate is expected to accelerate from 1 per cent p.a. to 3 per cent per annum over the next 20 years, starting about now.

“As this short-term concern dissipated the stock rallied and is up 30 per cent over the last five months.”

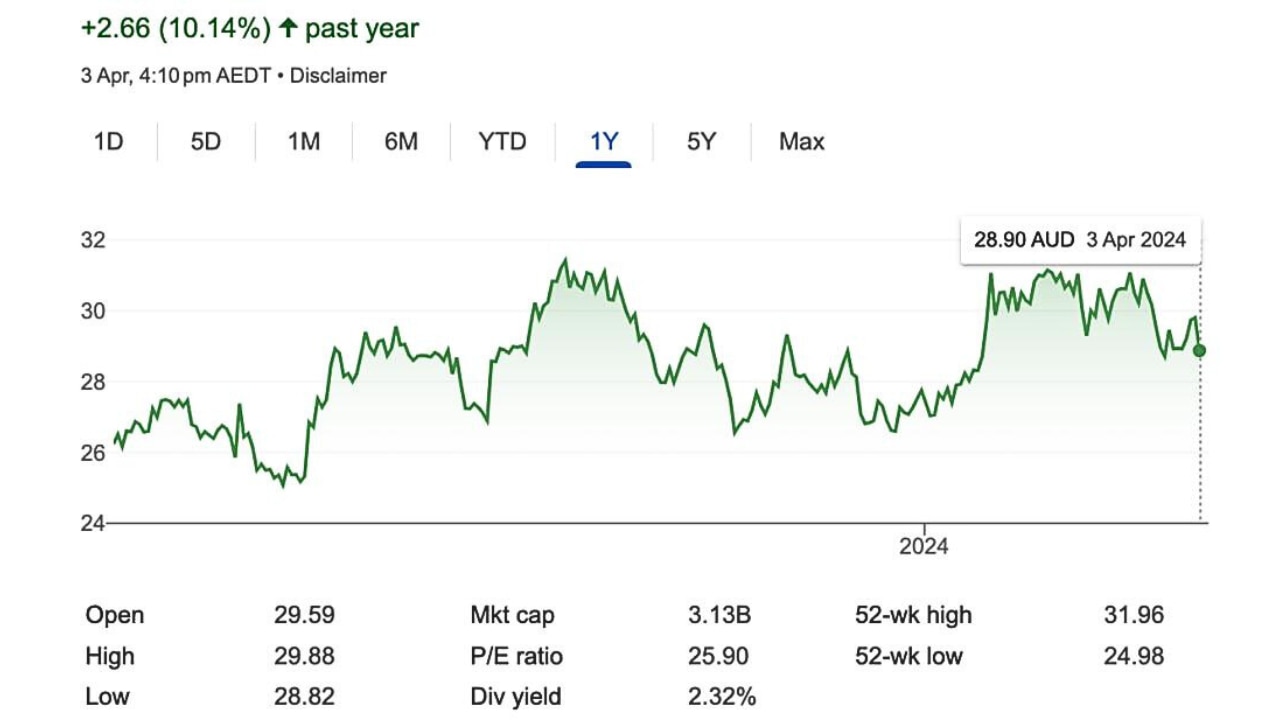

AUB GROUP (ASX:AUB)

Source: Google

Source: Google

“Shares continued to be buoyed by the strong premium rate environment as the Queensland floods continued the trend seen in recent years of these more frequent catastrophic events,” Ivers said.

For the six months to late February, AUB’s underlying NPAT rose to $70.2 million from $46.7 million a year earlier, and underlying revenue to $635.7 million from $466 million.

The listed broking group pulled off a turnaround in New Zealand, while the core engine of the business, Australian Broking, continues “ … operating at tremendous margins with lots more opportunities than we originally envisaged”, CEO Michael Emmett told investors.

AUB Group recently upwardly revised FY24 guidance is for underlying NPAT of $161-$171 million, compared with a previous $154-$164 million range.

The new guidance represents growth of 24.7-32.5 per cent from 2022-23.

Ivers said AUB had been one of their fund’s largest holdings, a stock up by double digits over the past year, but which saw a 23 per cent share price rise in 2023, which was largely matched by earnings growth.

“We continue to view the stock as attractively priced with a solid medium-term growth outlook driven by a combination of resilient top-line revenue growth and further margin expansion.”

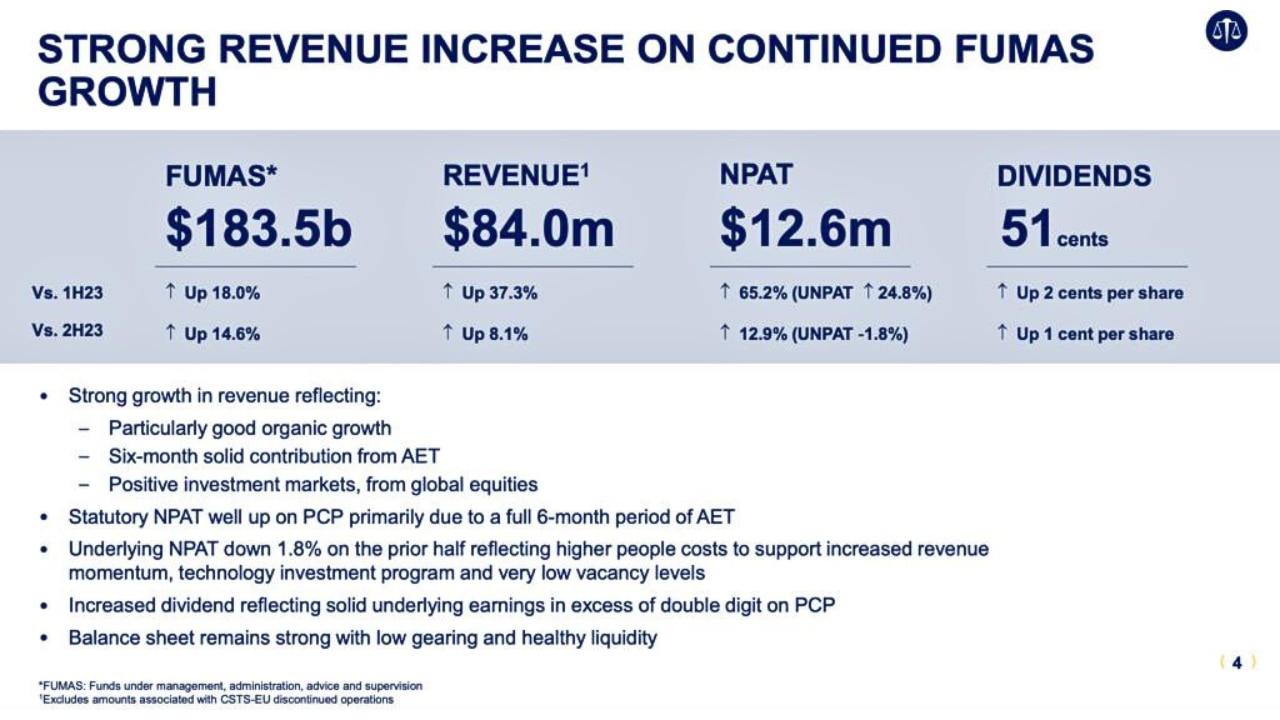

EQT HOLDINGS (ASX:EQT)

Source: Google

Source: Google

The guys say Equity Trustees, established as an independent trustee and executor company somewhere around 140 years ago, has become one of Australia’s largest specialist trustee companies.

“EQT has started the year well,” Ivers said.

“While there has been no new news, we note that the stock traded relatively flat in 2023 (+2 per cent) despite its strong medium-term earnings growth outlook.

“This is underpinned by the full earnings impact of its AET acquisition, in addition to further synergies being extracted as the company manages an increasing amount of AET’s funds under supervision in-house.”

“Additionally, the closure of the company’s loss-making UK/European business will further enhance earnings.

EQT’s performance. Source: EQT HY 24 results presentation

EQT’s performance. Source: EQT HY 24 results presentation

“Trading on a FY25 P/E of just 16x, we view the stock as materially undervalued, and it also features as one of the fund’s largest holdings,” Ivers said.

The final word: Consistency.

“Consistency,” Younger says. “It’s easy as investors to outsmart ourselves.

“But sometimes you need to stick with what works, and keep backing your process.”